The government in talk with Citibank on sovereign rating. The Uzbek government commenced first steps to obtain a sovereign credit rating and Citibank may be hired as advisor for such mandate, Jamshid Kuchkarov, Deputy Prime Minister of Uzbekistan stated today. “We are at the very starting point of efforts to obtain a sovereign rating. Citibank will be our advisor, perhaps, that will be a consortium of banks, this will be clear in the very near future” said Mr Kuchkarov. The decision for obtaining the sovereign credit rating is expected to be approved by the President of Uzbekistan soon, according to the senior government official. Mr Khurkarov noted that the government views the sovereign credit rating and follow-up international debt capital raising as one of the ways to diversify the country’s sources of funding.

Uzbekistan remains one of very few sizable countries in the world that does not have a sovereign credit rating to date. The government made initial preparatory work on the rating in the mid-1990s, however the leadership decided not proceed with seeking the sovereign rating. Therefore, Uzbekistan has never obtained such rating from any international credit rating agencies since its independence in 1991. Meanwhile, in recent years, over a dozen of Uzbek banks obtained their credit ratings from Moody’s, S&P and Fitch.

Uzbekistan remains one of very few sizable countries in the world that does not have a sovereign credit rating to date. The government made initial preparatory work on the rating in the mid-1990s, however the leadership decided not proceed with seeking the sovereign rating. Therefore, Uzbekistan has never obtained such rating from any international credit rating agencies since its independence in 1991. Meanwhile, in recent years, over a dozen of Uzbek banks obtained their credit ratings from Moody’s, S&P and Fitch.

“The sovereign rating is important, first of all, we need it to establish the benchmark”, said Mr. Kuchkarov. He also stated that once the sovereign rating is issued, it will allow large Uzbek companies and banks to attract funding in international capital markets.

Recent economic reforms. After his election on December 4, 2016, President Shavkat Mirziyoyev has started implementing comprehensive pro-market reforms in the country. The President initiated the Strategy for the Further Development of Uzbekistan in 2017-2021 that covers five main priorities: improvement of state construction, judicial and legal system, economic liberalization, development of the social sphere, and implementation of active foreign policy. Over the brief period, Uzbek authorities managed to reform the Parliament, unify the exchange rate through foreign exchange reform and liberalize foreign trade and the private sector. Technocratic officials have been appointed to key government positions and media was liberalized, which were unthinkable just a year ago.

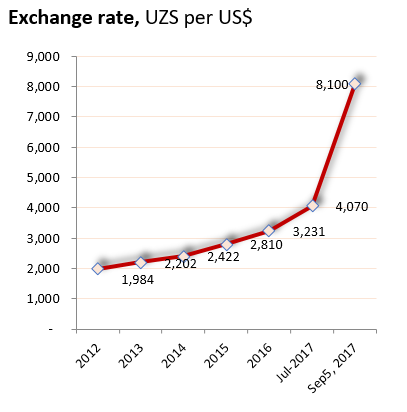

Currency unification. President Mirziyoyev issued a landmark decree on September 4 on liberalizing the currency exchange market, in particular unifying the multiple exchange rates and shifting to the use of market mechanisms in setting the exchange rate. As a result, the Central Bank of Uzbekistan (CBU) devalued national currency Uzbek Sum (UZS) almost by half to UZS8,100, starting Sep.5 and introduced new system of setting the exchange rate based on market principles. Uzbekistan is now complying with the provisions of Article VIII of the International Monetary Fund and introduced the long-awaited full convertibility of the national currency at a market rate.

Source: CBU, Statistics Committee of Uzbekistan, IMF, the authorities, Silk Capital estimates

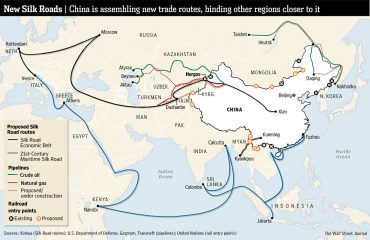

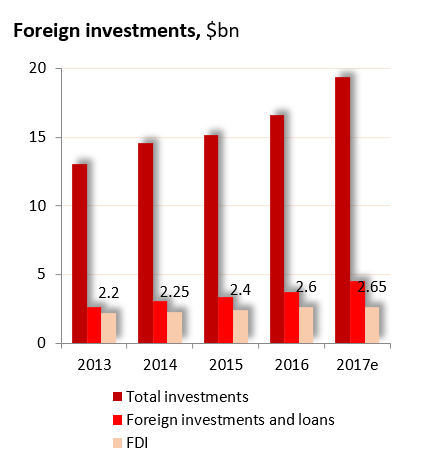

We believe that the government is committed to fully integrating the country into the global trade and financial system. Therefore, we expect the decision on obtaining the sovereign credit rating be forthcoming in the near future. The government plans to attract and direct billions of dollars to fund comprehensive modernization of the economy in the next five years and beyond. The leadership now seems to appreciate the importance of the sovereign credit rating and tapping international capital markets, considering the government’s historical preference to seek international funding to finance large infrastructure projects from multilateral and other development institutions. Over the last 25 years, Uzbekistan has been primarily working with institutions like the World Bank, ADB, EBRD and foreign government banks, in particular Chinese state-run lenders in securing loans.

We expect obtaining the long-awaited rating will be an important milestone for the government as it may decide to launch a debut sovereign bond in 2018. This will pave the way for state-owned enterprises and private sector groups to access international capital markets for the first time. We anticipate a strong interest among international investors for Uzbekistan’s maiden bond issue as the country represents an attractive growth story.

To download pdf version, please click here